Nvidia reported second-quarter revenue of $13.5 billion, well ahead of estimates of $11.2 billion.

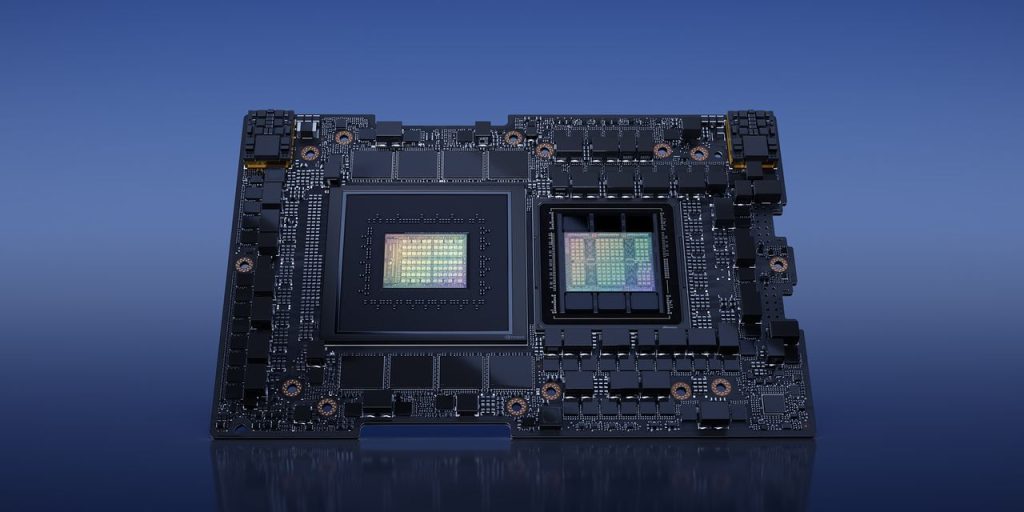

Courtesy of Nvidia

Stocks fell Thursday, giving up earlier gains following better-than-expected second-quarter earnings from

Nvidia

and as bond yields rose.

These stocks were making moves Thursday:

Nvidia

(ticker: NVDA) was up 2.7% after the graphics chip maker reported second-quarter revenue of $13.5 billion, smashing estimates of $11.2 billion. Data-center revenue soared 141% to $10.32 billion. Adjusted earnings of $2.70 a share also easily beat expectations of $2.08.

Nvidia

said it expects third-quarter revenue of $16 billion at the midpoint of its range, well above analysts’ consensus of $12.6 billion. CEO Jensen Huang credited a dramatic shift toward adoption of artificial intelligence for the robust results. Related stocks traded lower.

Taiwan Semiconductor

(TSM) fell 1.1%,

Advanced Micro Devices

(AMD) fell 6.6%,

Marvell Technology

(MRVL) was down 3.5%, and

Palantir Technologies

(PLTR) slid 7.4%.

AMC Entertainment

(AMC) was falling 25%. The movie-theater chain’s 10-for-1 reverse stock split went into effect Thursday.

Petco Health

(WOOF) slid 20% after the pet goods retailer slashed its earnings guidance for the fiscal year.

Splunk (SPLK) reported second-quarter adjusted earnings of 71 cents a share, easily surpassing analysts’ estimates. Revenue in the period rose 14% to $910.6 million, while cloud revenue jumped 29% to $445 million.

Splunk

said it expects third-quarter evenue of between $1.02 billion and $1.035 billion, topping analysts’ estimates of $982 million. Shares of the software company rose 14%.

Boeing

(BA) declined 3.6% over worries about a quality issue linked to supplier

Spirit AeroSystems

(SPR) that affects some 737 models.

Boeing

said the issue didn’t create an immediate safety problem, but “will impact near-term 737 deliveries.”

Spirit Aerosystems

fell 14%.

Dollar Tree

(DLTR) dropped 11% after the discount retailer tightened its earnings outlook for the fiscal year. It highlighted pressure on profits from inventory loss and consumers turning to lower-priced products. The stock was the worst performer in the

S&P 500.

Vizio Holding

(VZIO) dropped 9.6% after BofA analysts double downgraded the entertainment platform to Underperform from Buy.

Burlington Stores

(BURL) dropped 8.8% after the discount retailer cut its adjusted earnings guidance for the fiscal year.

Autodesk

(ADSK) posted second-quarter adjusted profit and revenue that topped Wall Street forecasts. The software company’s stock rose 3.1%. Shares have gained 13% this year.

T-Mobile

(TMUS) shares fell 1.9% after the mobile carrier disclosed in a filing that it will cut 5,000 positions, or a little under 7% of its total workforce.

Guess

(GES) jumped 27% after second-quarter adjusted earnings at the retailer beat analysts’ expectations and revenue rose 3% to $664.5 million, also higher than forecasts. The company said it expects third-quarter revenue to increase between 2.5% and 4.5%.

Write to Joe Woelfel at [email protected]

Read the full article here